Medicare Advantage

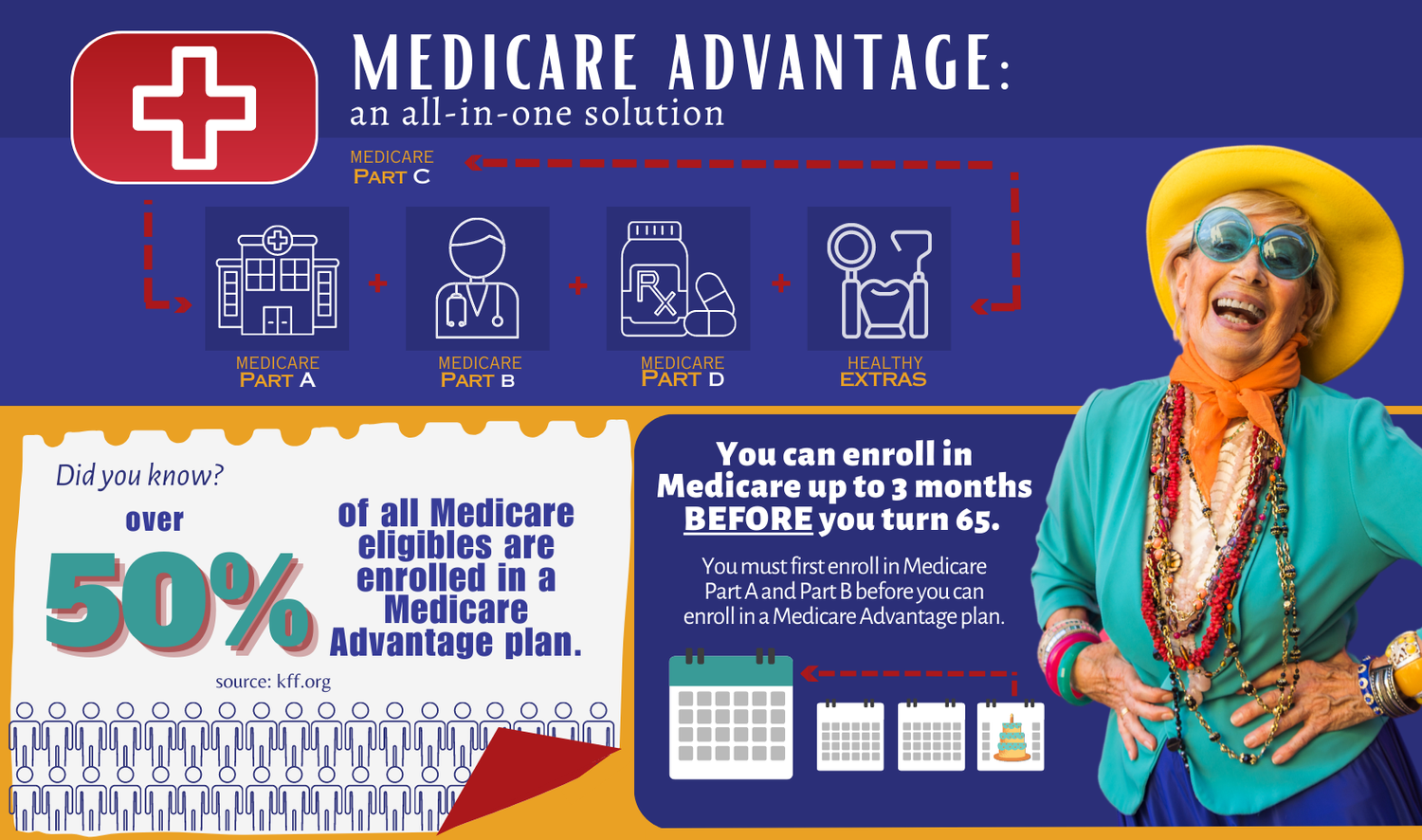

Medicare Advantage, also known as Medicare Part C, is a type of healthcare plan offered by private insurance companies as an alternative to Original Medicare (Part A and Part B). These plans are required by law to cover all of the same benefits as Original Medicare, but they often offer additional benefits such as prescription drug coverage, vision, dental, and hearing, and may have lower out-of-pocket costs. Most plans include prescription drug coverage as well.

Medicare Advantage plans are offered by private insurance companies approved by Medicare. These plans typically have a network of providers, and if you see an out-of-network provider, you may have to pay higher costs. Medicare Advantage plans also have an annual out-of-pocket maximum, which is the most you'll have to pay for covered services in a year. Once you reach this limit, your plan will pay for all covered services for the rest of the year.

Myths VS Facts

A common misconception about Medicare Advantage is that you lose your Medicare benefits. Instead, when you enroll in a Medicare Advantage plan you are still part of the Medicare program and your Medicare benefits are administered by the private insurance company. This means that the insurance company, rather than Medicare, will pay for your healthcare services. However, you still have the same rights and protections under Medicare, such as the right to appeal a coverage decision and the right to receive medically necessary services.